|

| Figure 4; Number of Owen Sound Employees on the Sunshine List source: 2021 Ontario Sunshine List |

Employee Growth Part II

|

| Figure 4; Number of Owen Sound Employees on the Sunshine List source: 2021 Ontario Sunshine List |

As shown above, we see clear evidence that Owen Sound is either overstaffed at the senior levels or paying senior staff salaries in excess of the norm. Owen Sound had 73 employees in 2021 receiving salaries greater than $100,000 at a total cost of $8,982,610. The closest municipality in the Primary Comparative Group is once again Strathroy-Caradoc with a total of 34 employees on the Sunshine List. That’s a difference of 39 employees. If the average salary for these 39 employees was $130,000, then that works out to about $5.0 million that we are paying our senior staff, more than Strathroy that has a larger population than Owen Sound.

|

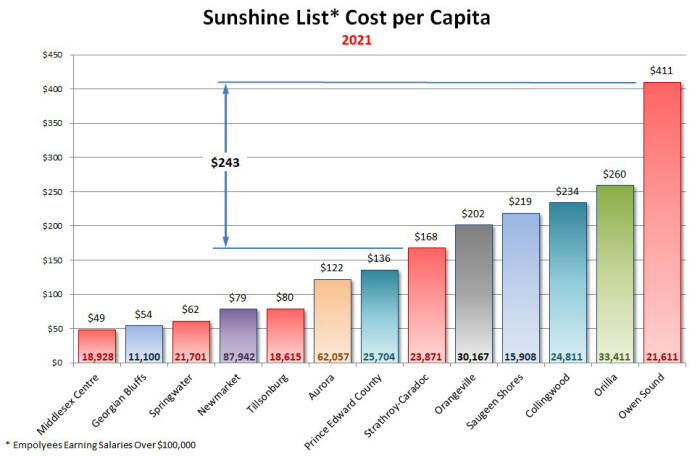

| Figure 5; Sunshine List: Cost of Employees per Capita source: 2021 Ontario Sunshine List |

When we look at the Sunshine List on a per capita basis we can see that Owen Sound clearly stands out among the others. The difference between Owen Sound and the nearest municipality in the Primary Comparative Group is $243. This means in order to support the numbers on the Sunshine List compared to Strathroy-Caradoc, Owen Sound pays $243 more per resident each year than Strathroy on senior staff salaries. When you multiply this by Owen Sound's population of 21,612, you see that that adds up to $5.2 million each and every year. We can now use this figure to get an estimate for the average salary of Owen Sound employees on the Sunshine List. The result is $134,659.

|

| Figure 6; Sunshine List Cost to Taxpayers source: 2021 Ontario Sunshine List |

When we look at what the Sunshine List is costing us each year, beyond what

Strathroy-Caradoc pays, it becomes clear why our Salaries and Benefits expense

is so high as compared to Strathroy. Owen Sound pays nearly $4.9 million more on

Sunshine List salaries than Strathroy-Caradoc. This suggests that senior staff

salaries have grown well beyond the city’s growth? This didn’t happen overnight.

I suspect that it occurred over a twenty (20) year period with annual

incremental changes that would go unnoticed in any particular budget year.

Regardless of how we got here, it appears that the city has an overabundance of

senior staff in comparison to Strathroy. Council owes it to taxpayers to fully

investigate this disparity and direct the changes necessary to right-size

management staff. However, given the magnitude of this disparity, it will take a

few years to correct this apparent imbalance.

If you recall the Salaries and Benefits expense difference between Owen Sound

and Strathroy was $11.6 million. We now know that $4.9 million of this is due to

senior staff salaries; with employee wages responsible for $6.7 million. Given

that Owen Sound’s current Salaries and Benefits expense is $25.9 million, a

reduction of 44.7% would be required to match Strathroy’s Salaries and Benefits

expense.

Verifying

the Results

So far we have compared Owen Sound with the other municipalities in the group

using two sources. First we used each municipality’s Audited Financial

Statements to compare Salaries and Benefits expense. Then we used the Sunshine

List to examine how Owen Sound compared when it comes to the number of employees

earning $100,000 or more in salary. In both of these cases we saw that Owen

Sound’s expenses were far greater than all others in the group.

One way seeing if these results make sense, is to take a look at total expenses

for these municipalities to see if the pattern of higher Salaries and Benefits

Expenses is reflected in Total Expenses.

|

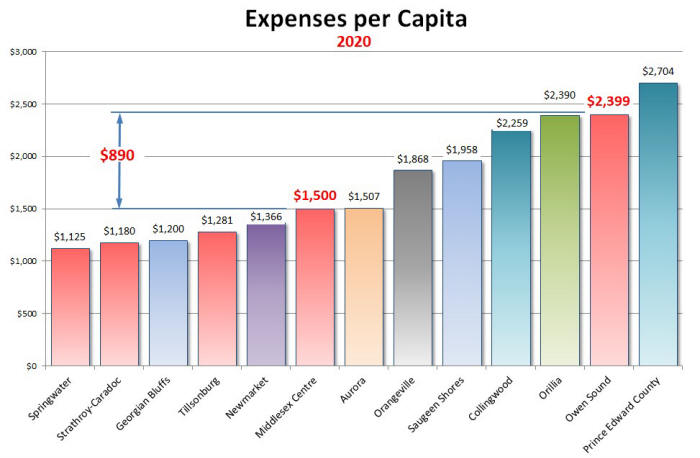

| Figure 7; Total Expenses per Capita source: Audited Financial Statements available on the Municipal websites |

Figure 7, shows total expenses per capita. When we look at our Primary

Comparative Group, as shown with red lettering, we see that Owen Sound once

again leads this group by significant margins. We see that Strathroy is quite a

bit lower than Owen Sound in total expenses. However, Middlesex Centre is the

closest this time with expenses per capita of $1,500 compared to Owen Sound at

$2,399. Although it does look like much, the difference of $890 per resident is

a huge sum. When you multiply this by Owen Sound’s population it works out to be

a difference in expenses to run the city of $19 million. Middlesex does have a

slightly smaller population so it could be that they do not provide the

same level of services that Owen Sound provided its residents.

This supports the data from the previous two sources and removes the uncertainty of contracted out services.

It makes it clear that one of

the reasons that Owen Sound needs higher taxes is to support the abnormally high

expenses as compared to Strathroy, Middlesex, Tillsonburg and Springwater. Again,

the reason for this could be that these municipalities are providing fewer

services; hence, it costs less to run their municipalities. The only way to know

for sure is to do a detailed service comparison with all four of these

municipalities. If they are providing the same services, at the same level,

whether contracted or not, then the solution is simple, reduce Owen Sound’s

expenses to match theirs. As we saw above this will likely require a reduction in the

workforce.

Conclusions

We saw that Owen Sound’s Salaries and Benefits Expense was, at a

minimum, $11.6 million more than what it should be based a comparison with Strathroy.

We then learned that Owen Sound has 73 senior staff earning

$100,000 or more, while the closest municipality to Owen Sound in the study, Strathroy, has only 34 senior staff on this List. That tells us that Owen Sound

could save at least $5,0 million each and every year if it just matched Strathroy’s

numbers on the Sunshine List.

There is no question that over the years successive councils have allowed

expenses in general to increase each year. From the relative difference between

Owen Sound and Strathroy, in Salaries and Benefits Expense it clear that Owen

Sound’s Expenses are abnormally high.

City staff stopped publishing comprehensive Full Time Equivalent (FTE) reports

in 2016. As well, 2020 was the last year they posted the Audit Financial

Statement’s on Owen Sound’s website. This has significantly reduced transparency

at city hall.

There are two actions that Council must take to stop the downward spiral, get

city expenses under control, and bring taxes down to match those in similarly

sized municipalities. They are:

Council must begin to hold the

City Manager accountable. It is his responsibility to manage city

expenditures in a cost-effective and financially responsible manner. He

should be bringing Council the most cost-effective draft budget each year

and not a budget padded with ‘wish lists’ of ‘nice to haves’.

This Budget Year we saw the City Manager request a $268,081 budget increase

for his office. That’s an increase of 71.9% to his budget at a time when

city growth has been virtually stagnant for many years. He should be setting

an example of ‘restraint’ not ‘extravagance’.

Council needs to direct the City Manager to do a detailed examination of

Strathroy’s and Springwater’s municipal expenses and report to Council why

Owen Sound, a municipality with a lower population, has total expenses that

are significantly higher than these two municipalities. Council owes it to

taxpayers to reduce Owen Sound’s expenses so that they are relatively equal

to Strathroy’s and Springwater’s expenses. It is time for Council to stop

putting relationships with staff ahead of relationships with taxpayers and

start demanding the City Manager deliver annual draft budgets with tax

reductions to offset the many years of annual tax increases.

There is no need to hire another consultant to do study why Owen Sound’s expenses are so much higher. Council needs to rely more on city staff and less on paid consultants to do the job that senior staff should be doing.

In all likelihood

this will involve staff reductions to match Strathroy’s staffing level.

The changes required to “Right-Size” the workforce, will require

a comprehensive plan to be developed which will need to be phased-in

over a minimum of two years. Springwater has contracted police services so a

comparison to Salaries and Benefits Expense is not appropriate. However,

comparing Owen Sound’s total expenses to theirs is very appropriate.

Council must improve transparency at city hall by including an FTE spreadsheet, broken down by department with the annual financial statements. The FTE Spreadsheet should include the previous year’s data so residents can see the changes in the workforce year to year. Although the annual department budgets do show their current workforce levels, these are not sufficient. In addition Council must direct the city’s auditing firm to include income statements for each department, in its annual report. It is not sufficient to have staff post departmental summaries. I have found numerous errors in these budget summaries and found that I can only trust the Audited Financial Statements. Yes, this will cost more, but it is essential to provide taxpayers with sufficient visibility into city operations to ensure that staff growth does not exceed population growth in the future.

On a positive note, a portion of the annual savings that will materialize from expense reductions should be directed to address our growing social problems. We currently have a very serious problem in our community where some of our residents are living in tents and sleeping in the streets. We saw that Owen Sound spends in the order of $12 million more on salaries and benefits than Strathroy. If Council were to begin to practice sound financial management and reduce expenses, by at least $10 million, to be close to Strathroy’s, we could provide housing for the 50 plus unhoused residents in Owen and at the same time have enough left over to give taxpayers an immediate 10% reduction in taxes as well as freeze taxes for the next five (5) years.